AMDY Dividend History: Unveiling Key Trends & Payouts

Introduction:

After studying the AMDY’s dividend timeline, investors who are looking for a regular income stream on their investments must find this information important. In the recent past, AMDY has made a reputation of itself in paying dividends and this has prompted short-term traders and those holding long-term portfolios to invest in it. Knowledge of the trends of the company’s dividend policies to AMDY is crucial while making the right investment choices for purchasing its stocks.

If you are keen on knowing how AMDY’s dividend payouts have changed over time,? Thus, let us examine the complete history and what this portends for future growth.

Information

AMDY is one of the well-known names in the financial markets and has been consistently upping its dividend payouts and is much favored by the dividend players. When you look at its dividend history, it is easy to figure out its nature, the rate of its growth and the performance compared to other firms. It is now time for further examination.

AMDY Dividend History: A Deep Dive Into the Past

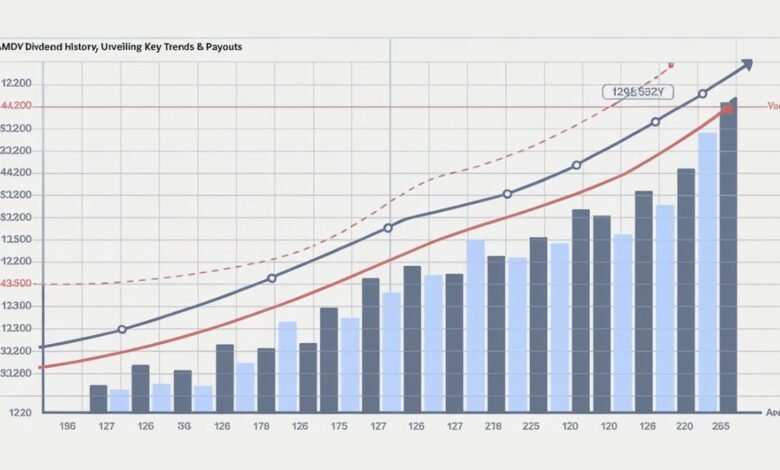

Knowledge of AMDY’s dividend policy provides an insight into its financial status and also the level of commitment towards shareholders. Overall, AMDY has been improving the trend of frequent increase in dividend payments over the past one decade, depicting strong financial prosperity of the firm. This stability is highly considered by investors as this speaks of strength that a company has in a given market. The analysis of the main payment dates will show the process of development of AMDY.

How AMDY Dividend Payouts Reflect Stock Performance

Payouts of Dividend policies can display the capacity of a company to generate profits. As depicted by the table below, AMDY’s payout ratios are consistent and in synchronization with the company’s stock whereby it pays appropriate returns to the shareholders. For the most part, the movement of stock price is usually highly related to the dividend declaration, further enhancing the opportunities for the investors to determine when to go for the stock or when to hold it. The company has also been able to improve on its dividend yield over the years because of its impressive growth in its stock value:

What’s Driving AMDY’s Dividend Growth?

Strong Revenue Streams: Hence, contrario, AMDY has been in a position to steadily increase its revenues from other segments of its business and thus be in a position to increase dividend payout to its shareholders.

Cost-Effective Management: Over the years, cost control and investment have improved the firm’s profitability enabling it to increase sustainable dividends.

Long-Term Growth Strategy: AMDY outlook also focuses on innovation, new markets, and acquisition, this requires long term growth to attain the financial strength required for continued dividend growth.

Comparing AMDY’s Dividend Yield With Industry Peers

When it comes to dividend yield AMDY also appears to be in a good standing as compared to other corporations in the same industry. Comparing dividend yields of the industry AMDY holds a position of a competitive dividend player. Investors often expect high dividends, and AMDY fully meets these expectations by paying generous amounts of cash to its shareholders. This stability allows the company to remain resilient in a volatile market, providing a reliable stream of income for investors.

Competitive Yield: The company’s present at AMDY has been constantly paying a dividend yield that is in line with, if not more than, the average of both the similar industries and has made it a good holding for the dividend seekers.

Steady Growth: Unlike other peers AMDY has been able to constantly increase its dividends thus exhibiting financial strength and stability.

Above-Average Payout Ratio: Hence, AMDY has been keeping an above-average payout ratio because it pays out reliable dividends without straining the company resources while matching with similar companies.

Strong Yield During Market Volatility: Other competitors or rivals may cut or at least reduce their dividend policies during down cycles to meet market conditions, which is not the case for AMDY that has either maintained or even boosted its yields in those unpredictable markets.

Consistent Dividend Increases: It is notably to have higher payout ratios with AMDY increasing its dividends more often than some of its industry counterparts sustaining flat payouts, and thus more sustainable long-term earnings growth probability.

AMDY’s Future Dividend Potential: What to Expect

Shareholders are never bored in getting to know the future prospects of the company’s dividend policies. Thus, with proper financial backing, AMDY has the resources to thrive. By focusing on the right growth strategy, the company is seen as able to continue giving back to its shareholders. They will probably continue growing in the future because of the company’s history and factors in the market. It has been forecasted that in subsequent quarters of the year, AMDY may hike its dividend yield. This makes it a lucrative option for both new and existing investors.

FAQs

How often does AMDY pay dividends?

AMDY typically pays dividends quarterly to its shareholders.

What is the current dividend yield for AMDY stock?

AMDY’s dividend yield varies but has recently hovered around competitive industry rates.

Is AMDY’s dividend history consistent?

Yes, AMDY has a consistent history of paying and increasing dividends over time.

How does AMDY’s dividend growth compare to competitors?

AMDY’s dividend growth is competitive and aligns well with industry leaders in its sector.

Can I reinvest dividends from AMDY stock?

Yes, many brokerages offer a dividend reinvestment plan (DRIP) for AMDY shareholders.

Conclusion

From the graph above, AMDY has proved to be a company willing to pay out dividends to its shareholders frequently. AMDY has built a positive image over the years by consistently paying dividends. The company has also issued sustainable stocks, appealing to investors interested in regular dividends. As AMDY continues to expand, its dividend capacity is expected to grow, offering even more profit opportunities. Purchasing AMDY stock is a smart decision for investors. It offers a stable income stream. The company has a proven track record of success. This makes it a reliable choice for long-term returns.